Overview

Irish Life, a leading insurance provider in Ireland, identified a need to build trust with consumers from target age groups towards digital products and online services in the insurance industry.

They also aimed to help in-house advisers with new tools that would make their lives easier and replace cumbersome binders with a digital database.

My role: Senior UX Designer

Team: 3 person

Tools: Figma, Zoom, Maze, Slack, Trello

Timeframe: 8 weeks

Team: 3 person

Tools: Figma, Zoom, Maze, Slack, Trello

Timeframe: 8 weeks

Challenge

To develop a user-friendly digital platform for an insurance company that enhances customer experience, streamlines adviser workflow, and increases customer engagement.

Customer: Limited and unengaging advice, Lengthy, linear, and inflexible processes, Lack of trust in advisers, Insufficient industry knowledge and digital capabilities

Adviser: Compliance burdens and hurdles, Difficulty in broadening advice conversations, Time-consuming non-advisory tasks, Fear of being replaced by automation

Solution

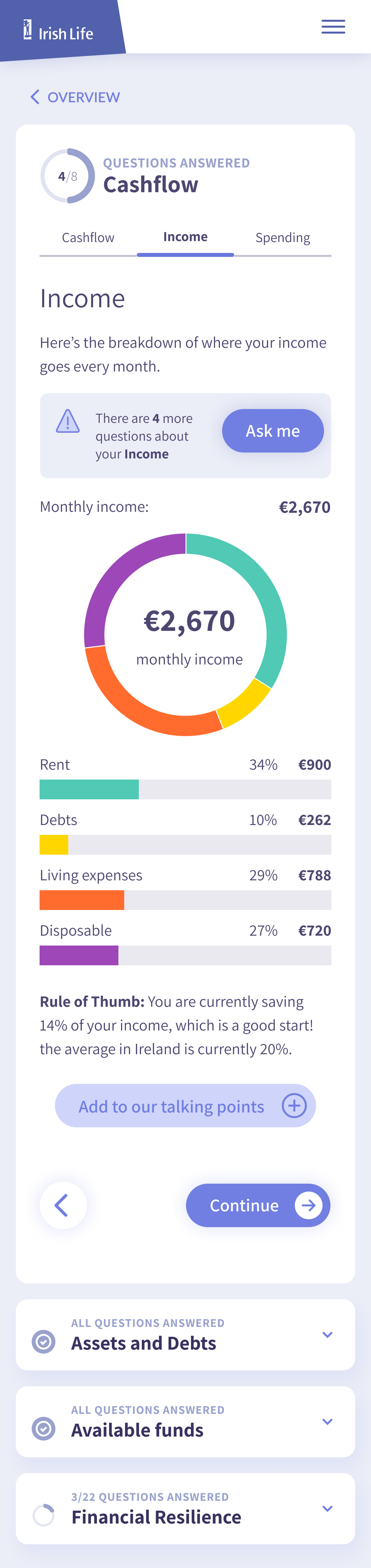

We developed an interactive, user-friendly digital platform that seamlessly integrates online customer data with the adviser's system, leveraging PSD2 and other sources to pre-fill customer information, and providing digital tools for customers to interact pre- or post-meeting.

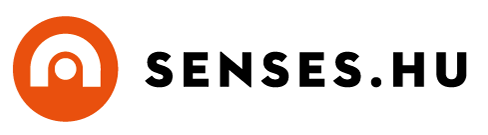

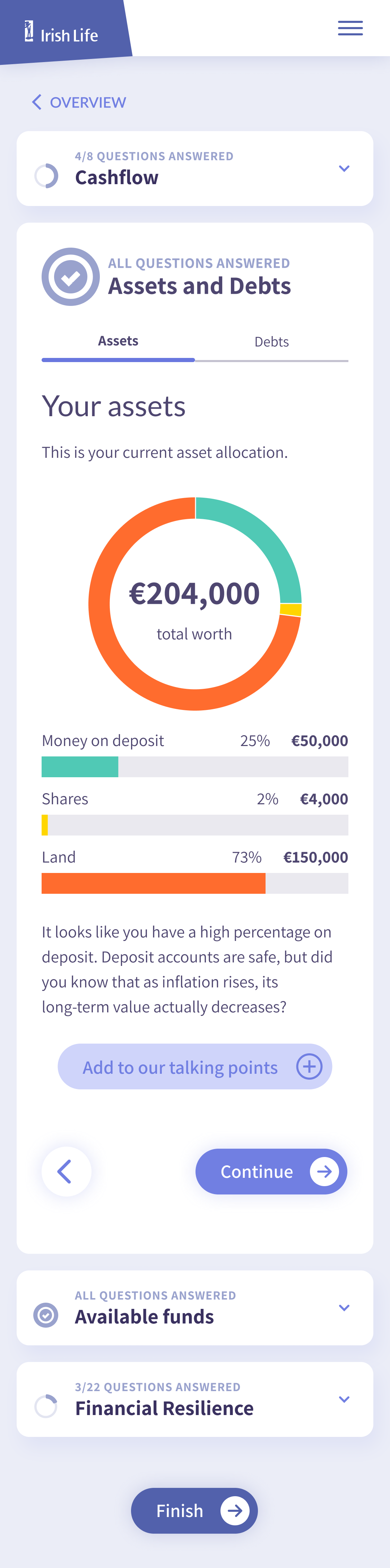

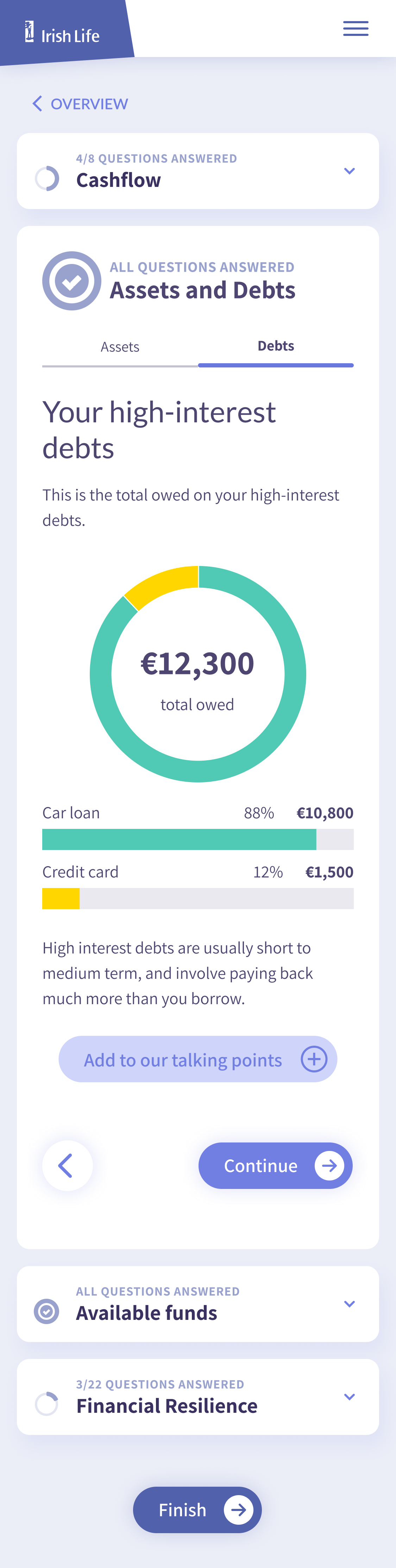

Our platform allows advisers to access all necessary information about their customers, including their spending habits, credit cards, and assets. It also enables them to have productive conversations with customers by walking them through their financial overview and highlighting their assets, total emergency money, and any gaps.

We also developed a risk profile tool that helps customers explore investment options and funds that suit their financial goals and risk appetite. The tool allows advisers to recommend investment plans based on customer preferences and investment profiles, and they can tweak these figures on-screen before moving into the recommended product(s) and fund(s).

Design & Prototype

I had the Design System to follow and update or amend as we go with creating new screens for the App.

Testing

In our case study, we employed quantitative testing methods using Maze and Usability Hub, gathering data from several hundred participants. For qualitative analysis, we conducted approximately 30 in-depth user tests and interviews, each lasting 45 minutes. These sessions included participants from diverse age groups, medical backgrounds, and financial situations to ensure a comprehensive understanding of user experiences.

Results

Following the implementation of these initiatives, Irish Life experienced the following:

Increased trust and engagement from customers, leading to higher satisfaction rates and greater customer retention.

Improved efficiency and productivity for advisers, allowing them to focus on their core advisory tasks.

Enhanced industry knowledge and understanding of Irish Life products and services among customers and advisers.

Strengthened relationships between customers and advisers, fostering long-term loyalty and reducing the perception of advisers as merely salespeople.

Streamlined and compliant digital processes that reduced administrative burdens for advisers and improved the overall customer experience.